Resources

The Importance of Asset Location in Retirement Income Planning

When it comes to the distribution of retirement assets, where those assets are located in the portfolio can have a direct bearing on how much income you receive. Periodic reviews are a good time to assess whether investments are properly situated to minimize future tax bills.

Estimating Health Care Costs in Retirement

Rising medical expenses means that no retirement plan is complete without some kind of provision for health care needs. Here are some guidelines and resources for estimating what health care could cost during retirement.

The 10 Basic Questions of Estate Planning

It’s not easy to contemplate your own mortality, but a good estate plan can provide for your heirs, protect your assets, and promote family harmony once you’re gone. Estate planning is complex and because it involves facing your own mortality, it can be difficult subject to address. While you most likely have a will, this simple document may not be sufficient to manage your estate and efficiently pass on assets to your heirs. Even if you have an estate plan that you’re confident in, it’s a good idea to review that plan.

The Art of Managing Retirement Assumptions

A retirement plan is built on a set of assumptions that can’t be validated until it’s too late. One key to successful retirement planning is carefully setting assumptions and revising them often.

Social Security Claiming Under the New Rules

On November 2, 2015, the Bipartisan Budget Act of 2015 was passed into law. In addition to budgetary provisions, the law closed certain “loopholes,” which changes the way married couples and divorced individuals may take advantage of Social Security benefits. Let’s look at how this may effect you…

Last Will & Testament: Add a Letter Covering These 14 Wishes

Having a will is necessary, but there is a great deal of information the legal document does not include. Here’s what to cover in a supplemental letter that specifies preferences,

discloses critical logistic info, and will save your family significant stress during a difficult time.

An Overview of Asset Transfer Strategies

You may need to transfer assets for all sorts of reasons. A working knowledge of various transfer techniques can help you determine when it’s appropriate to move money around, and how to minimize the tax and legal implications of the process.

10 Ways to Protect a Small Business From Hackers

As a small business owner you have a lot on your plate, but you need to start educating yourself on another issue threatening businesses.

6 Wealth & Success Lessons From The Ultimate Gift

Discover what it means to be wealthy or successful. If you’re like most, it takes a few hard knocks to understand what life truly has to offer. Several years ago at the Berkshire Hathaway annual shareholders meeting in Omaha, Neb., a precocious 10-year-old investor stood bravely in front of a microphone and posed a weighty question for the investment maestro: “How do you define success in life?” Warren Buffett didn’t hesitate—it was as if his whole life had prepared him for the answer. The world’s second-richest man replied in a matter-of-fact tone: “Success is when you reach the end of your life and you find that the people who should love you actually do love you.”

11 Ways to Minimize the Bite From the New Medicare Taxes

Two new Medicare taxes will throw some curveballs into your planning for 2016 and beyond. Here is what you need to know to navigate the 3.8% surtax on unearned investment income and the 0.9% additional tax on wages.

Is a Cash Windfall in Your Future?

It might look like “sudden money,” but cash windfalls are often easy to spot – sometimes years ahead of time – if you know where and how to look. Never is financial advice more urgently needed than when you come into a large amount of cash.

The 99% Rule for Spousal Beneficiaries of IRAs

A spouse who inherits an IRA or similar account has a couple of options available depending on what the end goals are. But in most cases, the 99% rule offers flexibility and helps preserve the stretch. It sounds odd to say, but death is a part of life for us all. It’s one of the few things that we all have in common at some point, and it’s one of the few issues that must be addressed in everyone’s plan.

Recent Market Volatility

I thought you might find the attached article about the market’s recent volatility interesting and here is an Executive summary of the Article for you:

1. WE SHOULD EXPECT VOLATILITY – It is important to remember how well-functioning capital markets work and what prices reflect; prices reflect the aggregate expectations of market participants (Fears of Risk, investors’ tastes and preferences, and expectations about future profits are among the many inputs that affect the markets “overall” expectations).

We should expect these inputs to vary day-to-day. As a result, we should expect prices, as well as the level of volatility, to fluctuate. It is interesting to think of the alternative: If prices did not adjust and remained constant, we would be concerned that markets were not functioning properly.

2. The market events of January 2016 provide an opportunity to examine several questions important to investors and revisit some fundamental principles of investing in capital markets.

3. IMPORTANCE OF DISCIPLINE – While in the midst of a market downturn, we may be inclined to look for some type of signal as to what the recent period means for future returns or to assume the current period is somehow different from what we have observed historically. Before jumping to conclusions about what the future may hold, studying market history can provide perspective. While the realized return over any snap-shot in time may be positive or negative, over the long term we believe markets will go up. As investors, we should remain disciplined through all periods in order to capture the expected returns the market offers.

15 Resources for Overwhelmed Caregivers

Studies show caregiving duties begin to take up more and more time as caregivers age. Fortunately, resources are available to help caregivers and their loved ones manage housing, budgeting, driving, and more.

Last Will & Testament: Add a Letter to Your Will Covering These Wishes

Many clients assume that when retirement rolls around, they should draw cash from their taxable accounts first. Generally, this is a good idea—but not always. Let’s look at which accounts you should tap into first.

How Parent & Child Assets Impact Financial Aid Packages

Parents with big investments and home equity generally find it harder to get financial aid for their college-bound children. But if you understand how assets are assessed on the FAFSA and CSS Financial Aid PROFILE, you can improve your chances for getting the best financial aid package possible.

Planning for a 30-Year Retirement

Funding a 30-year retirement will take financial planning prowess as you juggle the effects of inflation, distributions, taxes, asset allocation, and expenditures. Are you up to the task?

Retirement Income: Which Accounts to Tap First?

Many clients assume that when retirement rolls around, they should draw cash from their taxable accounts first. Generally, this is a good idea—but not always. Let’s look at which accounts you should tap into first.

Developing a Realizable Vision for Retirement

You can make the difficult transition into retirement easier by exploring your expectations and desires. With some careful prioritizing—and collaborating with your advisor—you can design a working plan for retirement that may surpass all your expectations.

9 Questions to Ask Your CPA at Tax Time

It’s time to gather paperwork and prepare your returns by April 18th. Since it’s likely been a year since you last spoke to your CPA, it’s important to outline any changes in your personal situation and familiarize yourself with changes in the tax code. Here are nine important questions to discuss with your CPA this tax season.

Cracking the Nest Egg: When Accumulation Becomes Distribution

It’s a big transition when you leave the workforce to live off your savings. Moving from an accumulation to a distribution strategy requires an attitude adjustment in both you and your advisor. Here are the issues to consider when time, compounding, and other conventional investment principles no longer work in your favor.

Essential Tax Tips for IRAs

Woe to the taxpayer who runs afoul of the numerous and confusing IRA rules. There are forms to file, contributions to make, distributions to take, and penalties to avoid. While corrections are possible, it’s best to avoid mistakes in the first place. Here’s what you need to know.

7 Questions to Ask Your CPA before Year-End

Given the complex tax situation many high-income earners face, start tax planning in the fall while there is still time to make adjustments. These seven questions can help you spot problem areas and better understand the services you may need.

Should Business Owners Put Spouse on Payroll for Social Security Purposes?

Social Security can be a tricky subject for many clients with added complexity for small business owners. One common question concerns compensation for family members and their eligibility for Social Security. Here are the factors to consider.

How Rising Interest Rates Can Affect Your Financial Plans

Whether you are managing debt, investing assets, or developing an estate plan, changes in interest rates represent an excellent opportunity to review your financial plan and consider new strategies designed to capitalize on changing conditions.

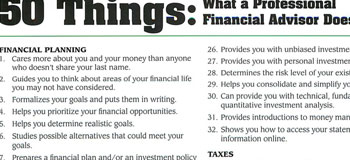

50 Things an FA does for you

Many people think a Financial Advisor just buys and sells stocks for a living. But there are many more key aspects to a Financial Advisor’s job that go beyond the surface. See how you could benefit by working with an Independent Financial Advisor.

5 Questions to Ask Clients 5 Years Before They Retire

When you think of retirement, do you picture yourself travelling the world or relaxing with family? In order to make that a reality, you have need to prepare by having a “life planning” conversation within five years of your retirement. Have you discussed with your Financial Advisor any of these retirement plan questions?

Consumer Guide to Financial Planning

When to apply for Social Security Benefits

Maximizing Social Security benefits is a critical part of retirement planning, and knowing when to apply just as important. Knowing your choices of when you can apply and how much you can receive is another factor in retirement planning you should consider with the help of your Financial Advisor.

Creative Social Security Claiming Strategies: Understanding the Nuances

With the Senior Citizens’ Freedom to Work Act of 2000, baby boomers are able to advantages to receive a little extra income from Social Security. With several strategies available, it is important to understand the nuances as they apply to you and time them just right. Read here to understand what applies to you.

The 99% Rule for Spousal Beneficiaries of IRA’s

Unfortunately, death is a part of life and it must be addressed in your financial plan. Not only what you are leaving behind, but how it could affect your spouse and their tax situation. Having a Financial Advisor to help you understand the intricacies of distributions and how to follow the “99% Rule” is important. Learn more here.

7 Ways to Help You Cut College Costs

Parents may assume they earn too much to qualify for financial aid. However, there are a number of strategies that even wealthy families can employ to cut expenses. Here are seven steps for estimating costs and maximizing financial aid.

2015 Charitable Tax Guide

With new rules changing the tax picture for many clients, it’s a good time to review IRS regulations surrounding charitable donations. Click here to find out what to keep in mind when deciding on donations in 2015.

How to Build a Retirement Health Care Budget

The most accurate and reliable way to determine your spending needs in retirement is to sit down and make up a budget projecting costs in the areas of housing, utilities, food, transportation, leisure activities, and so on. What is difficult for many people is figuring out the health care part of the budget. Here’s what to think about when you are building your retirement health care budget.

10 Ways to Protect a Small Business From Hackers

As a small business owner you have a lot on your plate, but you need to start educating yourself on another issue threatening businesses. Identity thieves have branched out. They’re not just after individuals anymore—businesses are the new target for hackers and fraudsters.

10 Tax Code Changes for 2015

Every New Year seems to usher in a host of new and confusing tax laws. Get prepared for tax season by familiarizing yourself with these 10 new rules plus 10 tips on how to work with them.

Understanding Guardianship for Older Adults

One day you may find yourself involved in guardianship proceedings for an elderly parent or relative. Here’s an overview of what guardianship means today, how the court evaluates the adult, and what you need to know.